Covid-19 is a trigger that will push a fragile global economy into recession, not the cause. The pending economic conditions are the consequence of poor economic policy and an inability to take difficult decisions, not the virus.

Policymakers have favoured short-term patch-work solutions over long-term sustainable solutions. “Short-termism”, as I like to call it, is obvious in central bank monetary policy, fiscal policy and our own personal decisions, which are affected by prevailing policy conditions. We need to cure societies’ short-term focus if we want to generate a positive, productive and sustainable future.

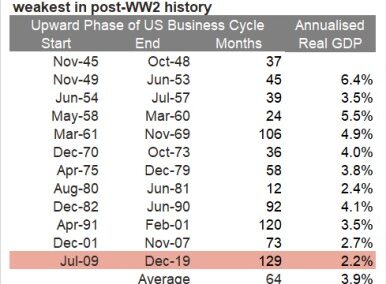

The US economy will enter a recession after the longest and weakest economic cycle on record. To December 2019 the US economy expanded for 11 years at 2.2% real annualised GDP, compared to the post-war average of 5 years and 3.9% annualised growth. The long but weak nature of the economic cycle is directly related to short-termism.

Policymakers across the globe did their utmost to prolong the cycle and banish the recession. Overuse of economic policy is a global phenomenon, not America’s alone. I focus on America because it’s the world’s largest economy, but whether you live in Turkey or Italy, the trends are the same.

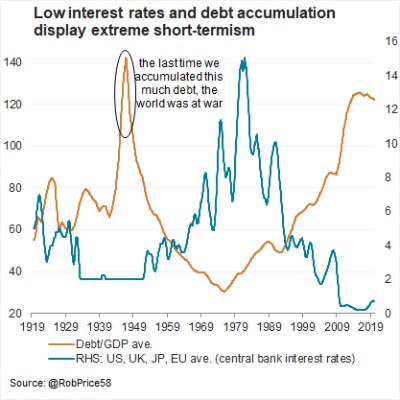

Previous Federal Reserve Chairperson Janet Yellen went as far as to say that another economic crisis “will not be in our lifetime.” The Fed lowered interest rates to zero in December 2008 and only started increasing interest rates in December 2015, which allowed it to create the longest business cycle in post-war history, but not without consequences.

High interest rates

Interest rates provide an indication of our time preference: the choice between consuming today vs. the future. High interest rates encourage deferred consumption, savings and real investment, which are the drivers of long-term economic growth. When interest rates are zero, there is limited benefit to deferred consumption and savings.

This encourages people to spend now, boosting short-term economic growth at the expense of long-term growth. Blame shouldn’t be targeted at central banks alone; President Trump’s expansive spending policies and pressure levied on the Fed are characteristic of short-term focused politicians.

Of the G7 countries only Germany, and briefly Canada, balanced their budgets in the post-financial crisis period. Most governments prefer a policy of favouring the present over the future, favouring the current election cycle over the next, spending far more than they earn in tax revenue and putting the repayment burden on the shoulders of future generations. Policy actions impact personal consumption and business investment decisions.

Sweeping problems under the carpet

Spend and consume now but pay for it later with little consideration of the consequences, that’s what we’re told. But did I really need that brand-new German luxury vehicle or was it just the leverage that made it seem affordable?

Was WeWork truly a profitable business model or was it just low mortgage rates that made office space seem so cheap? Was an investment into South African bonds really a good idea or was it just the fact that global interest rates were so low that made South Africa’s interest rates look attractive?

Low interest rates and debt hide economic risk, they hide bad decisions and bad ideas. They make everything seem like a good idea, as though there are no consequences or costs. But pretend and reality are not the same thing. There are costs and there are consequences. When the cycle turns, the costs are the consequences laid bare.

With society sitting at home during the corona pandemic, individuals, businesses and corporations are questioning their investment and consumption decisions. Credit rating downgrades are usually clustered around economic recessions, which is symptomatic of a re-pricing of bad decisions. The UK and South Africa’s governments, along with many corporates, were downgraded in March 2020. Expect more as the tide goes out and exposes those who didn’t take precautions.

Falling savings and reduced real investment, combined with compounding economic errors, hamper productivity. It is no surprise then that real economic growth rates have declined during this cycle of extended short-termism. Society has consumed capital, become less productive and mortgaged the future in order to make the present more palatable. This short-termism can only persist for so long.

Economic healing process

Just as winter serves its purpose before spring, recessions serve their purpose. Recessions are painful, but they are the economic healing process that allows regeneration. Bad business decisions are uncovered, and capital is reallocated towards productive ventures. This is good for society, but it’s also good for individuals to allocate their time and energies towards ventures that are worthwhile.

Banishing recessions is dangerous because it allows deadwood to collect in the economy. When authorities persist with short-termism, we’re left with a forest full of dry kindling that can catch alight with the smallest of sparks. By contrast, more frequent forest fires allow the disposal of deadwood and a healthy ecosystem where green shoots reappear quickly.

After an 11-year cycle of policymaker imprudence, the global economy is filled with deadwood. Government debt levels and interest rates are at levels comparable with those after WW2, which highlights their overuse.

Unsurprisingly, monetary and fiscal authorities are trying to cushion the blow of this economic crisis with more debt and lower interest rates. The Federal Reserve has lowered interest rates to zero. It plans to expand its balance sheet by $5.5tn and the US Treasury will expand its balance sheet north of $6tn.

Returning to short-termism

The more support that authorities provide to corporates, the less deadwood is burnt off and the weaker the recovery becomes. The economy is crying out for an economic correction mechanism, a write-down of debts, a re-allocation of capital and a re-pricing of risk. Governments know this will be painful, so they’ll try their utmost to prevent it, returning to short-termism.

But with debt levels so high and interest rates so low, there isn’t much gas left in the tank. A non-trivial number of defaults and delinquencies will take place during this cycle despite the fiscal and monetary support. Small businesses with less access to the political powerbrokers and funding lines will likely suffer more than big businesses, further negatively impacting productivity and job growth.

Economic analysts who talk about a quick “v-shaped” economic recovery are smoking their socks. They’re probably focused on the faulty idea that the economy has been hit by a virus but everything else is fine. This is nonsense. They’re pretending that we’re only facing up to the coronavirus but are ignoring the underlying troubles.

The global economy is reaching the end of an 11-year business cycle and the biggest debt supercycle since WW2, after years of economic policy short-termism.

Opportunity to build stronger foundations

Pockets of opportunity are certainly emerging, within financial markets, for direct investment and for individual growth. Society will re-emerge from this crisis, hopefully stronger than before, but there is a long road ahead to cure the global economy from its dangerous prioritisation of the present over the future.

The more we reflect on our mistakes, the better foundations we build for our future. We need to push back against short-termism and encourage sustainable long-term solutions to our problems. Practical old-school “boring” values will earn their stripes through these times; savings, not living beyond one’s means, careful consumption and long-term planning.

These values run in direct contrast to those encouraged by the short-termism endemic, which favours reckless consumption, debt growth and living beyond one’s means. Time will tell who wins out in this tug-of-war. I know where I’m putting my bets.

This article was first published on pricelesseconomics.

The views of the writer are not necessarily the views of the Daily Friend or the IRR

If you like what you have just read, subscribe to the Daily Friend

Photo by Stephen Dawson on Unsplash