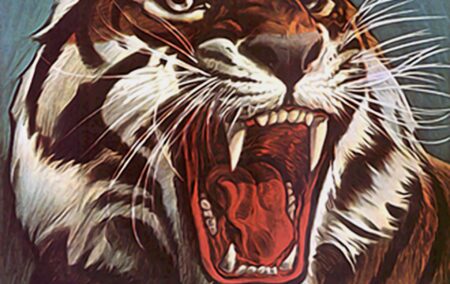

A key theme of global politics is starting to emerge: incumbents shouldn’t sleep too soundly – the tiger of inflation is loose and scenting blood.

Joe Biden’s approval rating has fallen to 36%, nearing the 34% approval rating with which his predecessor, Donald Trump, left office in the aftermath of events at the Capitol on 6 January 2021.

Biden’s falling approval rating continues to be driven by dissatisfaction with his handling of economic matters; among these, generationally unknown levels of inflation related to the high cost of fuel and spilling over into other cost-of-living concerns.

Having since fallen to below $4.50 per gallon, fuel peaked at over $5 per gallon in June this year – significantly higher than the $4.11 of July 2008, the previous record high. In the US, inflation on the price of food rose to over 7% in 2022 for the first time since 1981.

On the back of these increases in the cost of living, Biden’s unpopularity will likely be a significant weight on his party’s performance in the upcoming November congressional elections. The Democratic Party is expected to lose its control of both the Senate, where Vice President Kamala Harris holds the tie-breaking vote in a 50-50 chamber, and the House of Representatives, where the Democrats hold 220 seats – two more than the minimum to have majority control of the lower chamber.

For the second time in recent history, economic factors, primarily the cost of living, are posing an essentially blanket, across-the-board threat to incumbent governments the world over.

Fallout

In the wake of the financial crisis of 2008/9, numerous incumbent governments were unseated as the fallout of the crisis left all but the most asset-rich worse off. In the US, John McCain, the Republican Party candidate for the presidency, felt the effect of the outgoing Bush administration on the crisis, as well as dissatisfaction with Bush’s foreign policy. He lost to Barack Obama in November 2008. In the UK, the Labour Party of Gordon Brown, despite receiving much praise for his immediate handling of the catalytic events of the crisis, lost power in 2010. Also in 2010 in Australia, the Labor Party of Julia Gillard lost its parliamentary majority in the Federal House of Representatives, limping on for another term, only to be comprehensively defeated in the 2013 elections by the Liberal-National Coalition of Tony Abbott. Nicolas Sarkozy in France never regained his pre-crisis approval ratings and lost the subsequent 2012 presidential election. In Japan’s 2009 general election, the Liberal Democratic Party lost power for the first time since its founding in 1955. In South Africa, the 2009 elections saw the incumbent ANC of Jacob Zuma lose electoral ground for the first time since its initial participation in formal electoral politics.

In exceptional circumstances, this curse of incumbency passed over political parties, notably in Germany, where Angela Merkel’s Christian Democratic Union improved its electoral performance. This was not the case for its then grand-coalition partners in the Social Democratic Party. The German electorate in 2009, while giving Merkel and her party a larger share of the vote, overall moved to the economic centre-right, with the Free Democratic Party replacing the SDP as Merkel’s coalition partner.

As in the aftermath of the 2008/9 financial crisis, incumbency has again emerged as a liability, with the inflation-driven cost-of-living crisis weighing heavily as an electoral issue.

Top priority

An early indication of this was Scott Morrison’s Liberal-National coalition losing office in May 2022, after nine years in power. For Australian voters, the cost of living was the top priority. Inflation in Australia soared to its highest level since 2011 in the first quarter of 2022, higher than expected. This surge coincided with the federal election campaign that culminated in Morrison’s loss to Labor’s Anthony Albanese.

In France, while he was not ousted from office, Emmanuel Macron saw his 2017 election opponent Marine Le Pen gain more support: from 34% of the votes in the final round in 2017 to 41% in 2022. Macron’s own support fell from 66% to 59%. Tellingly, Le Pen campaigned with laser-sharp focus on the cost of living, rather than her traditional nationalism theme.

In Japan, the assassination of former Prime Minister Shinzo Abe preceded his party, the LDP, improving its electoral standing in the July 2022 elections for the House of Councillors. Abe’s death is considered to have benefited his party. It’s notable that Japan has so far managed to avoid the sharpest edge of the global inflation spiral. However, last week did see inflation in the country remain above the Bank of Japan’s target of 2%. In April and May, inflation in Japan stood at 2.1%, rising to 2.2% in June. These rates of inflation, while higher than the Bank’s target, remain comparatively low – so much so that the Bank of Japan has not yet altered course on its policy of low interest rates.

In the United Kingdom, the incumbent Conservative Party is in the process of electing a new leader and Prime Minister to succeed Boris Johnson. His handling of the inflation-driven cost-of-living crisis has come under heavy criticism, contributing to Johnson’s perceived electoral weakness after a year of scandals and questions over his honesty and integrity.

Central plank

The contenders to succeed Johnson are former Chancellor of the Exchequer Rishi Sunak and Foreign Secretary Liz Truss, both of whom have made the cost-of-living crisis the central plank of their leadership pitch. Sunak seeks to pursue a policy of fiscal consolidation with limited tax relief so as to tame inflation, whereas Truss seeks to slice billions in taxes to relieve cost-of-living pressures, while reconsidering the Bank of England’s mandate on monetary policy and inflation targeting.

Both candidates are under fierce criticism for their economic policies – Sunak, for having, while Chancellor, placed the highest overall tax burden on British taxpayers in 70 years, along with his plans to reduce government spending, risking depressed consumer activity and recession; Truss, for seeking to increase government debt to fund tax cuts at a time when the costs of borrowing are likely to increase significantly, and for risking inflationary tax reductions at a time when productivity and market output have yet to recover sufficiently to justify the availability of money.

In Germany, opinion polls reflect how inflation concerns have damaged the standing of the SDP, the largest party of the governing coalition. Inflation rose from 5.1% in February to 7.3% in March. Since April, the SDP has led or equalled the opposition CDU/CSU in only 9 out of 97 opinion polls. The most recent poll showed a SDP lead dating from survey work done on 8 and 9 May. In terms of preferred Chancellor, the SDP’s Scholz, while maintaining a clear advantage over the CDU/CSU’s Merz, last achieved majority preference above 50% in March, failing to clear this point in the 27 most recent polls.

Global error

According to Lord Mervyn King, renowned former governor of the Bank of England for a decade between 2003 and 2013, the global error of central banks loosening monetary supply at a time of low productivity caused the textbook definitional circumstance of inflation to materialise: too much money chasing too few goods. The good news is that central banks have slowed monetary policy and the current, quite unnecessary global inflationary period will prove to be transitory – though in a timescale of years rather than months. Similarly beneficial to the macro-economic outlook, if not quite for the financial security of individuals with mortgage and other forms of debt, is the near-universal raising of interest rates.

However, there is now a real risk of two conflicting interests of the global economy colliding: in attempting to tame inflation, central banks have realised the necessity of raising interest rates, but these raise the risk of recession by throttling consumer spending – especially for the world’s asset-poor economic participants. Recession on a global scale now seems almost inevitable as a necessary stabiliser due to the decrease such would effectuate on economic activity. The political cost of another global recession now is likely to apply a self-defeating brake to the raising of interest rates, making the inflation tiger more difficult to cage.

Inflation and its cost-of-living consequences will likely play a significant role in electoral politics at least until 2024, by which time the effects of loose monetary policies globally are likely to ease.

This means that the next South African parliamentary and provincial elections, the next UK general election, the next two cycles of US congressional elections as well as the next presidential election and the next French senatorial elections are to take place before the end of the current period of global inflation. The turmoil of politics and public opinion related to inflation-driven cost-of-living crises will likely see incumbency remain an electoral liability for the immediate and medium-term future.

[Image: https://pixabay.com/illustrations/tiger-animal-wild-zoo-nature-988489/]

If you like what you have just read, support the Daily Friend